With interest rates rising, everyone’s in a rush to buy a home before rates surge even higher. Yet the homebuying process can’t easily be hurried. A variety of steps are involved, and each one takes time.

Which begs the question: Exactly how long does it take to buy a house?

In general, you can expect the homebuying process to take about four to six months from start to finish. While that might seem long, it could be shorter—or longer—depending on a variety of factors, like how choosy you are about where you live, how competitive your local market is, and more.

The homebuying process today is also markedly different from what it was even a year ago, and this might affect your timeline, too. So before you head in unprepared and suffer whiplash at the frenetic pace (or wonder why is this mortgage approval taking so long?), it’s essential that you know what to expect.

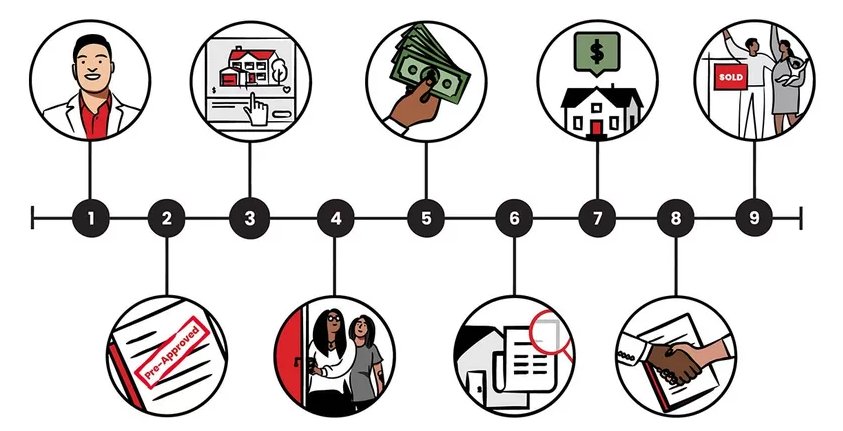

To help, we’ve broken down the nine major steps in the homebuying timeline, from beginning to end, and how long each stage typically takes. Remember, these numbers can vary widely, and many of these steps can be concurrent. We’ve also highlighted what can slow things down, and what you can do to speed things up if you’re in a rush.

Homebuying timeline: 9 steps to buy a house

- Find a real estate agent

- Get pre-approved for a mortgage

- Browse real estate listings

- Schedule home tours

- Make an offer

- Schedule a home inspection

- Set up the home appraisal

- Get your loan approved

- Close the deal

1. Find a real estate agent

Average time: 1 to 2 weeks

While hiring a real estate agent takes almost no time at all—you meet, then sign a contract agreeing to the agent’s representation—most experts say it’s wise for homebuyers to interview at least three agents before picking the one they think they’ll work with best.

Agents, after all, are not one-size-fits-all; they specialize in certain areas and types of clientele. Some enjoy the rewards of educating first-time homebuyers, whereas others might prefer more experienced buyers at higher price ranges.

Meanwhile, you might also have your own preferences for an agent in terms of their personality and communication style.

Christian Wallace, head of real estate services at online mortgage company Better, suggests knowing what an agent’s technology skills are.

“Because homes are selling so fast, if you can’t get there on the first day but your agent can, [they can] do FaceTime or video,” says Wallace. This can help you decide whether the house is worth the trek to see in person, which could be a huge time and energy saver.

All in all, given the homebuying process can be emotional and even stressful, you’ll want to find the best agent for you.

Here’s more on how to find real estate agents in your area and read up on their reviews, expertise, and more, as well as some questions to ask a real estate agent to help you find the right one for you.

2. Get pre-approved for a mortgage

Average time: 2 days to 2 weeks

A mortgage pre-approval is a letter from a bank stating up to what amount of money you qualify to borrow. While it’s not a final commitment from the lender (that comes later), it will help you set your budget and show sellers that you are in good financial standing to purchase a home.

To come up with the pre-approval figure, lenders need to verify your assets, which takes time. The best way to speed this process along is to have all your paperwork at the ready. This includes recent pay stubs, federal tax returns, W-2 forms, bank and other asset statements, your credit score and report, proof of employment, and residential history.

In the past, it wasn’t necessary to be pre-approved before making an offer, but in today’s hyper-competitive market, it’s virtually impossible not to be, as it’s become the accepted norm. A pre-approval letter shows sellers you’re serious about buying a house and have the cash on hand to follow through.

Agent Hilary Farnum-Fasth, owner of Corcoran Reverie in Northwest Florida, suggests obtaining a proof of funds letter to go along with your pre-approval letter to further speed up the process. This is a letter from a bank that shows you have enough liquid cash to cover the down payment and associated costs.

Keep in mind that most mortgage pre-approval letters come with an expiration date of 30, 60, or 90 days. It’s advisable to negotiate for a 90-day term so you have a buffer should the entire process take longer.

3. Browse real estate listings

Average time: 3 days to 3-plus months

Now comes the fun part: browsing real estate listings! To make sure you’re seeing everything and the most up-to-date listings available, you’ll want to check a site that aggregates multiple-listing service feeds like Realtor.com®. To find the right homes for you, make sure to limit your search by price range, location, size, number of bedrooms and bathrooms, and must-have features (e.g., a large backyard, fireplace, or home office). Check the listings daily, and set up online alerts that will inform you of newly listed properties that meet your criteria. Remember, time is of the essence in this hyper-competitive market.

Today, many real estate listings have virtual tours and 3D renderings so you can get a really good feel for a property without setting foot inside. This is a huge time saver, and while some buyers might even be comfortable making an offer sight unseen, most will use virtual tours as a way to narrow down which homes they want to visit in person. Once you find those worthy contenders, let your real estate agent know so the agent can schedule your home showings.

4. Schedule home tours

Average time: 3 weeks to 3-plus months

Nationwide, homes are selling much faster now than they ever have in the past, spending a mere 34 days on the market before getting snapped up. That’s almost a full month less time than before the COVID-19 pandemic took hold, according to Realtor.com data. If you’re shopping in a strong seller’s market with high demand and low supply, you might even see homes end up in contract in as little as a day or two after their first open house.

Jessica Lautz, vice president of demographics and behavioral insights at the National Association of Realtors®, estimates that the current average home search time is eight weeks, though she notes that “first-time buyers typically do have a longer search time for a home, and it’s because of the price point they’re typically in. … It’s a more affordable price point, [but] there’s less inventory on the market.”

First-time homebuyers might also face some tough competition and get dragged into bidding wars, which could drive up the price or knock them out of the running.

“Because there is so much demand and such little supply, buyers may have to put in several bids and go through many transactions before actually getting into a contract,” says Heather Harrison, an agent in New York’s Westchester County.

So although you might try and fail to get an offer accepted, landing you back at square one and lengthening your timeline, you can boost your odds of success by being aggressive. Saw a home online you’re in love with? Don’t wait until the weekend to go see it. Contact your agent immediately, and try to physically visit the property that same day.

5. Make an offer and negotiate

Average time: 1 day to 2 weeks

Assuming your finances are in order and you have a pre-approval letter in hand, you should have no problem making a day-of offer when you’ve found a home you love. Though there’s no rule on how long a seller has to accept (or reject) an offer, 24 to 48 hours is what’s commonly practiced.

However, if a seller is considering multiple offers, a couple of days could turn into a week, especially if the seller is waiting on a counteroffer from a different buyer.

One way to make your offer more appealing to sellers is offering to put down extra earnest money. Earnest money is a deposit that almost all buyers make to essentially take the home off the market; it typically ranges from 1% to 3% of the home’s value and is held in an escrow account. Without it, buyers could make offers on multiple homes, leaving sellers scrambling. Once the deal goes through, the earnest money then goes toward the down payment or closing costs. The more you can put down, the more committed you seem to sellers. But don’t take this step lightly: If the deal goes south, you might not get this deposit back.

Another tip is to have a plan in place if the seller comes back to you with a counteroffer. What’s the highest you’re willing to pay or put down? Are you willing to waive any contingencies (e.g., a home inspection)? In general, a buyer is expected to respond to a counteroffer within 72 hours, but doing so as soon as possible will definitely paint you in a favorable light and move things along.

Once an offer is accepted by the seller, the property will likely go into contract in just a few days.

6. Schedule a home inspection

Average time: 3 to 10 days

Once the home is in contract, you’ll enter what is known as the due diligence period, a window when the buyer is able to make sure everything is up to snuff (or back out of the deal if it’s not).

The main thing that occurs during this time is the home inspection, where a certified inspector will conduct a thorough assessment of the property to see if there are any issues that could cost the buyer money down the road. If there are problems, the due diligence period will likely take longer, as the buyer can choose to negotiate the price down or ask the seller to have the repairs made as part of the agreement.

In today’s fast-paced market, some eager buyers are choosing what’s referred to as a “walk-and-talk consultation” instead of a typical home inspection, which could cut the due diligence period to three or five days. During such a consultation, the buyer will do a walk-through with a home inspector, where the inspector will look at the most major structural flaws that would be expensive to fix, such as a faulty foundation or an old roof that needs to be replaced.

Some buyers might even consider waiving their home inspection contingency altogether since this removes one hurdle and might entice sellers to accept their offer over others. Still, most real estate agents don’t recommend forgoing the inspection as that comes with sizable risks.

7. Set up the home appraisal

Average time: 3 days to 3 weeks

Simply put, an appraisal is an unbiased determination by a certified appraiser of a home’s current value. This is based on the appraiser visiting the house, then researching factors like structural issues, size, and neighborhood comps. An appraisal is important because if a home is appraised for less than the asking price, it could affect your lender’s willingness to back the current loan terms.

The two ways to work around this are to put more money down (and lower the loan amount) or negotiate the selling price down with the seller. Either way, a low appraisal will add time to the process.

In her Northwest Florida market, agent Hilary Farnum-Fasth has seen a delay in appraisals since appraisers are backed up. To mitigate this, she’s seen buyers pay extra for a rush appraisal, which can get the job done in just a few days.

8. Get your loan approved

Average time: 3 days to 3 weeks

Being pre-approved definitely puts you in a good position to get your actual mortgage approved, and it will make this second step much quicker since all of your paperwork has already been submitted (assuming your pre-approval letter is still valid).

What takes time now is the underwriting process. An underwriter will do an extremely in-depth review of your finances and credit, as well as the property details, to verify that everything checks out.

If all of your paperwork is together and no major red flags come up, underwriting can take as little as two to three days. But for buyers with more complicated assets or purchases, it can take more than a week. For this reason, Julie Bombardo of Corcoran Premier Realty in Orlando, FL, stresses the importance of working with a local lender.

“We have a particular lender here in town, that he just has to go down the elevator three floors and he’s in his underwriting division,” she says.

Overall, the best thing buyers can do is be as responsive as possible to requests that come from the lender or underwriter.

9. Close the deal

Average time: 2 days to 1 week

You’ve reached the finish line! The home closing is the point in the process in which all parties come together to sign all the documents and officially exchange ownership of the home.

In the past, you might have to sign all the paperwork in a room with agents, attorneys, and a lender representative present. But now, in many states, closings can happen remotely, which helps save time. In Northwest Florida, Farnum-Fasth says, “everything’s done electronically. Everything is done via FedEx or through electronic closing companies.”

So if getting this real estate deal over and done is a high priority, make sure to ask if a remote closing is an option.